2025: The year market regime mattered more than market direction | AI generated image by XBTO

2025 delivered a paradox for digital asset investors: Bitcoin reached new all-time highs of $126,198 in early October, yet finished down -6.4%. Ethereum ended down -10.9%, despite nearly reaching its own all-time high of $4,953.

Despite significant intra-year moves and continued institutional adoption through crypto ETFs, prices failed to establish sustained trends.

Bitcoin traded in a wide range from $75,000 to $126,000 before settling into a tighter $85,000–$90,000 range at year-end, underperforming other asset classes.

Bitcoin performance vs traditional asset classes

For institutional allocators, 2025 reinforced a fundamental truth: in digital assets, market regime matters more than market direction.

2025 Crypto market in numbers

2025 was a year of volatility without direction. While institutional adoption accelerated and regulatory frameworks matured, price action failed to follow. Markets oscillated in wide ranges, with momentum reversing before trends could establish. What emerged was a year where structure, volatility regimes, leverage dynamics, and dispersion, determined outcomes far more than directional conviction.

Key price dynamics:

- BTC range: $75,000 to $126,000, settled at $85,000–$90,000 by year-end

- Crypto total market cap peaked at ~$4.3 trillion, then gave back gains

- Price reversals dominated over sustained directional moves

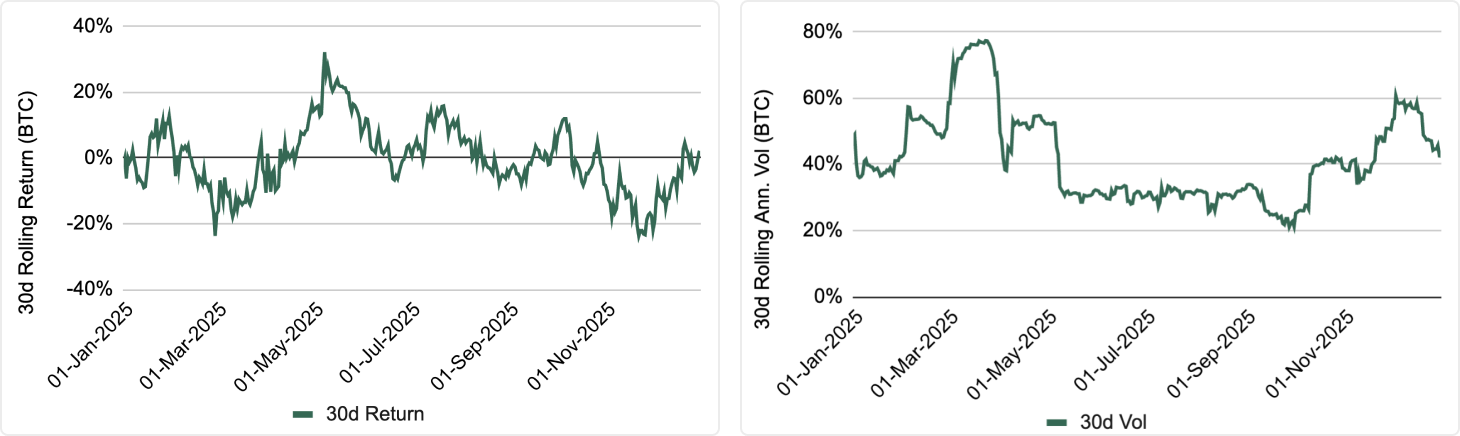

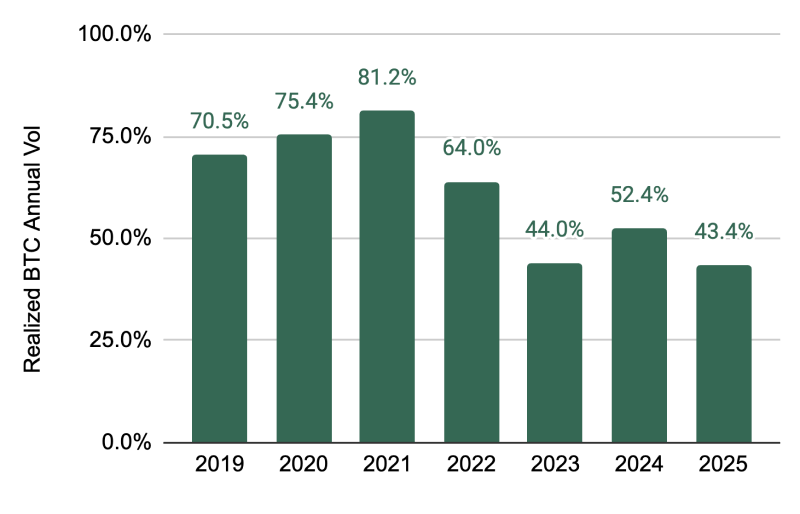

Volatility dropped to 43%, squeezing premium strategies

Beneath the surface, 2025's volatility profile differed markedly from prior years. Realized volatility averaged 43%, down from 52% in 2024, a -17% decline that signaled a quieter, more range-bound market. Implied volatility remained compressed for extended periods, with brief spikes around macro shocks.

This compression created challenges for momentum strategies and reduced option premium opportunities. Strategies relying on volatility expansion or sustained trends faced frequent whipsaw.

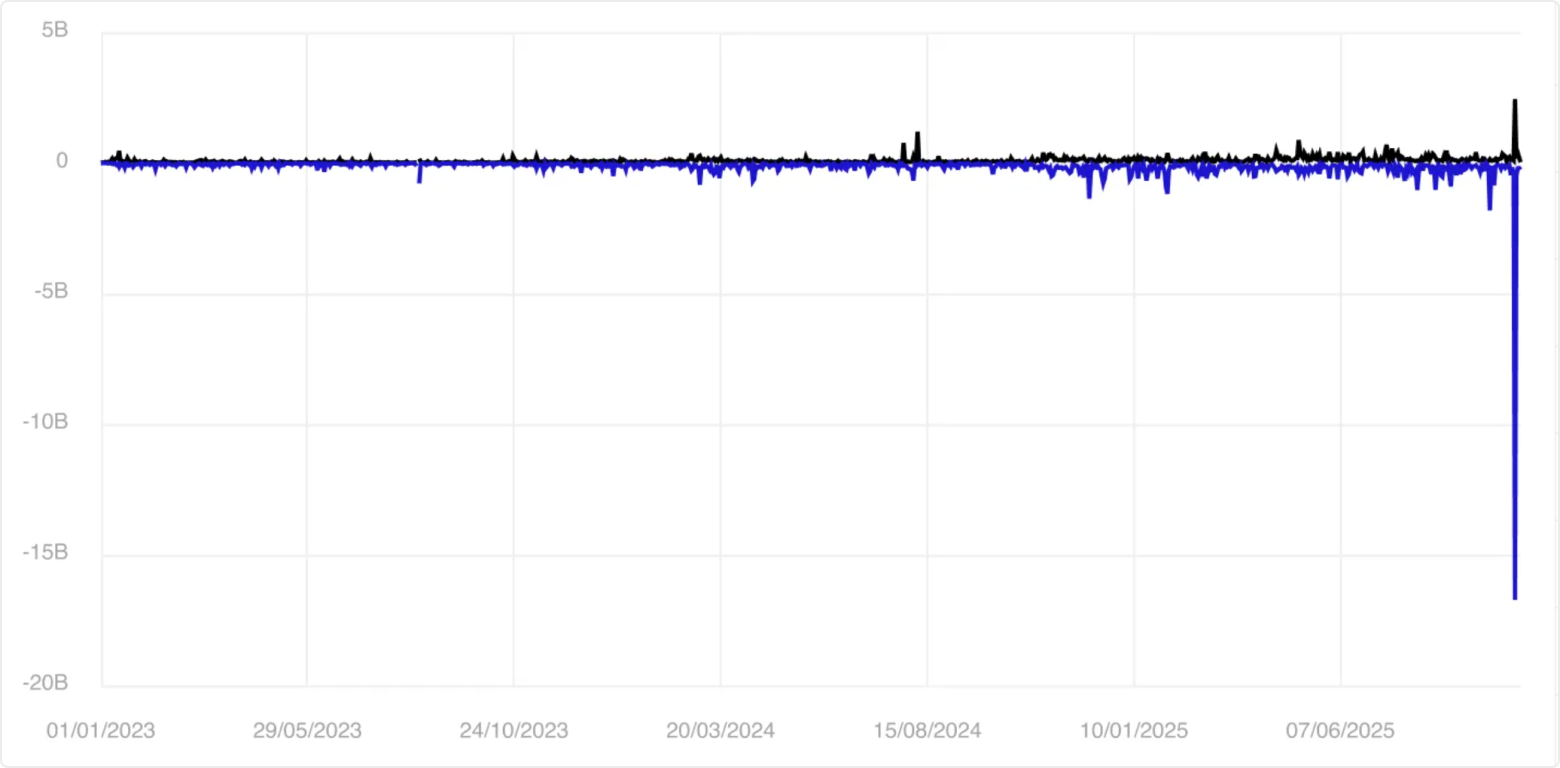

The $19 billion liquidation event

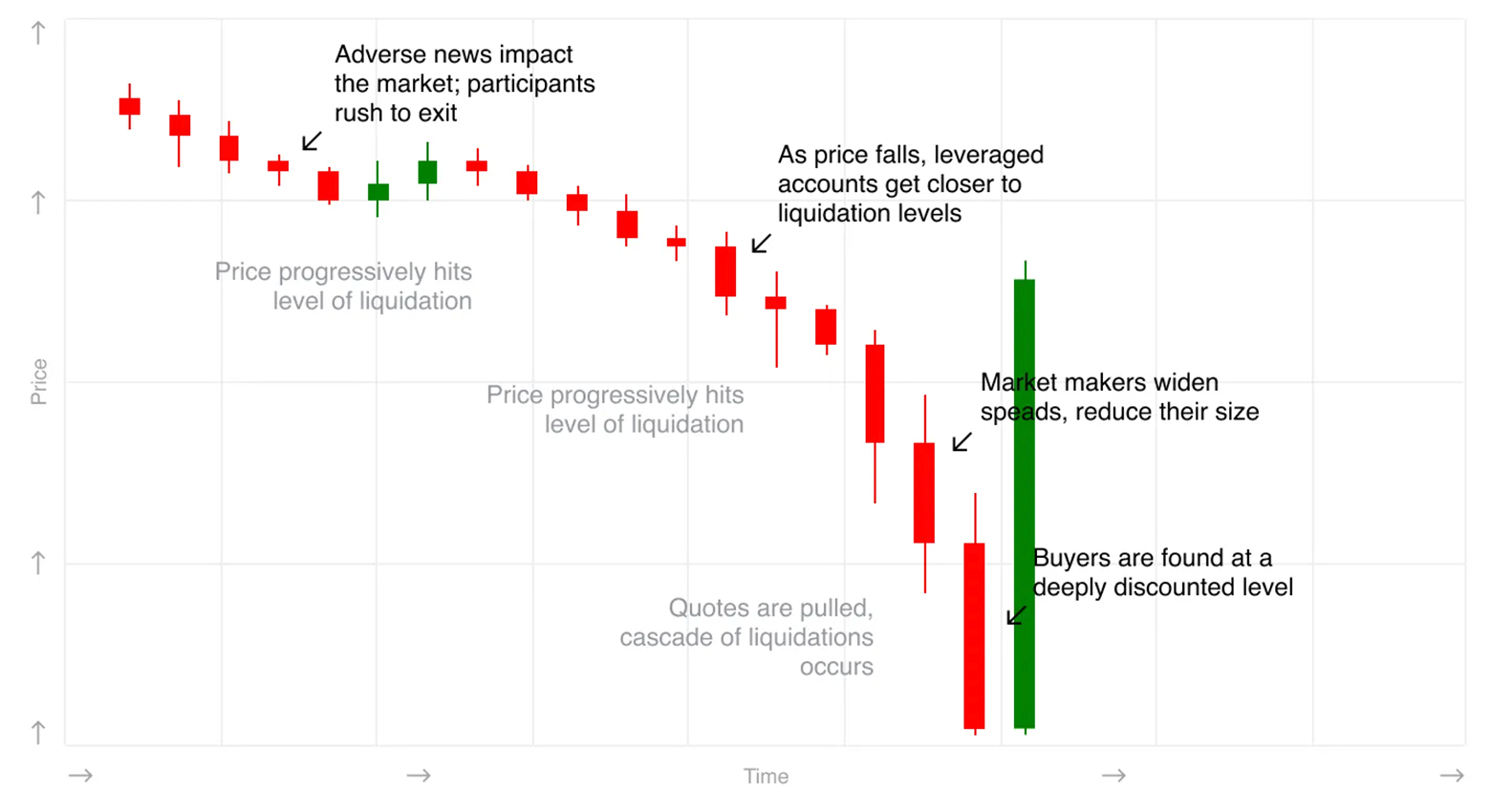

The year's most significant price move was driven by forced liquidation, not fundamentals. On October 10, following renewed tariff announcements, Bitcoin fell from $122,000 to $102,000 intraday. Approximately $19 billion in leveraged positions were liquidated in 24 hours - the largest liquidation event in crypto history.

Long-term Bitcoin holders capitalized on October's highs, selling approximately $45 billion worth of BTC over a 30-day period. The combination of profit-taking and forced liquidations reshaped market positioning for the remainder of 2025.

Total liquidations per day (all cryptoassets - US$)

Understanding liquidations cascade

$70+ billion in institutional assets, price action diverged

Despite volatility and reversals, institutional milestones accumulated:

- BlackRock's IBIT: $68.3 billion in assets (still one of the most successful ETF launches ever)

- XRP ETFs: Five new funds surpassed $1 billion collectively within weeks of launch

- Harvard University: Tripled Bitcoin ETF investment to $443 million (one of its five largest positions)

- Stablecoins: Total market reached $310 billion (as of December 22), driven by GENIUS Act regulatory clarity

Yet these milestones failed to translate into sustained upward price momentum. The disconnect reinforced a key lesson: market structure - volatility regimes, leverage dynamics, trend persistence - mattered more than adoption metrics.

For institutional allocators

2025 demonstrated that digital assets have become increasingly macro-sensitive, particularly at inflection points.

Several critical lessons emerged:

Active vs. passive in 2025: A tale of two approaches

In a year where Bitcoin hit all-time highs yet finished negative, the difference between passive and active strategies became starkly evident. Markets characterized by frequent reversals, compressed volatility, and short-lived momentum rewarded adaptability over conviction.

Regime awareness over market direction

Strategy outcomes were shaped by volatility structure, trend persistence, and dispersion - not by headline price levels or directional bets. Both upward and downward trends failed to persist long enough for momentum signals to fully develop. Strategies that adapted to regime changes - volatility compression, mean reversion, and cross-asset dispersion - had structural advantages over those relying on sustained directional moves.

What passive strategies missed

Buy-and-hold strategies faced a challenging year:

- BTC: -6.4%, ETH: -10.9%

- Drawdowns exceeding 30% from peak to trough during October's deleveraging

- Full exposure to whipsaw losses during each reversal

- No ability to adapt or hedge during forced liquidation cascades

The cost extended beyond negative returns - passive portfolios captured none of the relative-value opportunities that emerged during compressed volatility periods.

What active management captured

Active managers had multiple avenues to generate returns in 2025:

Positioning for 2026: Measured risk-taking and adaptive discipline

We enter 2026 following a year that reinforced the importance of regime awareness and disciplined execution. Crypto continues to mature, becoming more institutional, more regulated, and more macro-sensitive - while still exhibiting periods of dislocation, leverage-driven repricing, and episodic volatility.

A maturing yet volatile market

Institutional participation is broadening through multiple channels:

- ETFs and regulated products: BlackRock's $68.3 billion IBIT, new XRP and altcoin ETFs expanding access

- Derivatives markets: Growing institutional hedging activity and sophisticated positioning

- Regulatory clarity: Targeted frameworks like the GENIUS Act reducing uncertainty

- Corporate treasuries: Strategy's 673,783 BTC ($60 billion) pioneering the treasury model

These developments improve market depth while changing the character of price action. Markets are increasingly integrated into global financial systems, yet remain prone to abrupt resets driven by leverage and macro shocks.

What to watch in 2026

Our 2026 approach: Adaptability over prediction

Our strategies are designed to respond to changes in volatility, dispersion, and trend persistence - not to predict them. After paying the cost of operating through a low-volatility, reversal-heavy, range-bound environment in 2025, we believe our strategies are well positioned for a broader set of outcomes in the year ahead.

Key principles for 2026:

For institutional allocators: Three questions for 2026

As you evaluate digital asset strategies for the year ahead, consider:

Digital assets remain a compelling opportunity for institutional portfolios - offering diversification, uncorrelated returns, and exposure to structural adoption trends. But as 2025 demonstrated, how you access that opportunity matters as much as whether you access it at all.

The full breakdown

In our first article, "Navigating Crypto Volatility: The Advantages of Active Management," we explored how the high volatility and low correlation of digital assets with traditional asset classes create unique opportunities for active managers. We discussed how these characteristics enable active managers to execute tactical trading strategies, capitalizing on short-term price movements and market inefficiencies. Building on that foundation, we now turn our attention to the unique market microstructure of digital assets.

Conducive market microstructure of digital assets

The market microstructure of digital assets - a framework that defines how crypto trades are conducted, including order execution, price formation, and market interactions - sets the stage for active management to thrive. This unique ecosystem, characterized by its continuous trading hours, diverse trading venues, and substantial market liquidity, offers several advantages for active management, providing a fertile ground for sophisticated investment strategies.

24/7/365 market access

One of the defining characteristics of digital asset markets is their continuous, round-the-clock operation.

Unlike traditional financial markets that operate within specific hours, cryptocurrency markets are open 24 hours a day, seven days a week, all year round. This continuous trading capability is particularly advantageous for active managers for several reasons:

- Immediate response to market events: Unlike traditional markets that close after regular trading hours, digital asset markets allow managers to react immediately to breaking news or events that could impact asset prices. For instance, if a significant economic policy change occurs over the weekend, managers can adjust their positions in real-time without waiting for markets to open.

- Managing volatility: Continuous trading provides more opportunities to capitalize on price movements and volatility. Active managers can take advantage of this by implementing strategies such as short-term trading or hedging to mitigate risks and lock in gains whenever market conditions change. For instance, if there’s a sudden drop in the price of Bitcoin, managers can quickly sell their holdings to minimize losses or buy in to capitalize on the lower prices.

Variety of trading venues

The proliferation and variety of trading venues is another crucial element of the digital asset market structure. The extensive landscape of over 200 centralized exchanges (CEX) and more than 500 decentralized exchanges (DEX) offers a wide array of platforms for cryptocurrency trading. This diversity is beneficial for active managers in several ways:

- Risk management and diversification: By spreading trades across various exchanges, active managers can mitigate counterparty risk associated with any single platform. Additionally, the ability to trade on both CEX and DEX platforms allows managers to diversify their strategies, incorporating different levels of decentralization, regulatory environments, and security features.

- Arbitrage opportunities: Different venues often exhibit price discrepancies, presenting arbitrage opportunities. For example, managers can buy an asset on one exchange at a lower price and sell it on another where the price is higher, thus generating risk-free profits.

- Access to diverse liquidity pools: Multiple trading venues provide access to diverse liquidity pools, ensuring that managers can execute large trades without significantly impacting the market price.

Spot and derivatives markets (Variety of instruments)

The seamless integration of spot and derivatives markets within the digital asset space presents a considerable advantage for active managers. With substantial liquidity in both markets, they can implement sophisticated trading strategies and manage risk more effectively.

For instance, as of August 8 2024, Bitcoin (BTC) boasts a daily spot trading volume of $40.44 billion and an open interest in futures of $27.75 billion. Additionally, derivatives such as futures, options, and perpetual contracts enable managers to hedge positions, leverage trades, and employ complex strategies that can amplify returns.

Overall, the benefits for active managers include:

- Hedging and risk management: Derivatives offer a powerful tool for hedging against unfavorable price movements, enabling more efficient risk management. For instance, a manager holding a substantial amount of Bitcoin in the spot market can use Bitcoin futures contracts to safeguard against potential price drops, thereby enhancing risk control.

- Access to leverage: Managers can use derivatives to leverage their positions, amplifying potential returns while maintaining control over risk exposure. For instance, by employing options, a manager can gain exposure to an underlying asset with only a fraction of the capital needed for a direct spot purchase, thereby enabling more capital-efficient investment strategies.

- Strategic flexibility: By integrating spot and derivatives markets, managers can implement sophisticated strategies designed to capitalize on diverse market conditions. For instance, they may engage in volatility selling, where options are sold to generate income from market volatility, regardless of price direction. Additionally, managers can leverage favorable funding rates in perpetual futures markets to enhance yield generation. Basis trading, another strategy, involves taking offsetting positions in spot and futures markets to profit from price differentials, enabling returns that are independent of market movements.

Exploiting market inefficiencies

Digital asset markets, being relatively nascent, are less efficient compared to traditional financial markets. These inefficiencies arise from various factors, including regulatory differences, market segmentation, and varying levels of market maturity. For example:

- Pricing anomalies: Phenomena like the "Kimchi premium," where cryptocurrency prices in South Korea trade at a premium compared to other markets, create arbitrage opportunities. Managers can exploit these by buying assets in one market and selling them in another at a higher price.

- Exploiting mispricings: Active managers can identify and capitalize on mispricings caused by market inefficiencies, using strategies such as statistical arbitrage and mean reversion.

The unique aspects of the digital asset market structure create an exceptionally conducive environment for active management. Continuous trading hours and diverse venues provide the flexibility to react quickly to market changes, ensuring timely execution of trades. The availability of both spot and derivatives markets supports a wide range of sophisticated trading strategies, from hedging to leveraging positions. Market inefficiencies and pricing anomalies offer numerous opportunities for generating alpha, making active management particularly effective in the digital asset space. Furthermore, the ability to hedge and manage risk through derivatives, along with exploiting uncorrelated performance, enhances portfolio resilience and stability.

In our next article, we'll delve into the various techniques active managers employ in the digital asset markets, showcasing real-world use cases.

Read full disclaimer